Why you can’t afford to NOT know your costs

Sébastien Boivin CPA, CMA

Director, DECIMAL

Whether it’s the public sector wanting to know program costs or the private sector seeking to optimize profitability, gaining a thorough understanding of your product and service costs is an essential organizational tool.

COST MODEL FEATURES FOR PUBLIC AND PRIVATE ORGANIZATIONS

Before we talk about implementing costing, let’s highlight some features of a quality cost model that enable users to derive maximum benefit and minimize the downsides.

Targeting the right information

If your organization’s resources for implementing and maintaining a cost model are limited, you should focus on your business needs and move away from other non-essential or non-priority needs. A long-term viability issue for any model is time-consuming updates and difficulty using the information it generates. In other words, if the model initially focussed on 10 business needs, ideally, the model would be developed to address only those needs. Any new needs that come to light should be documented, and the Finance department must come up with a strategy to add information to each new iteration of the model once delivered, after assessing whether or not it’s appropriate to annually add this information to the model. Ad hoc needs should be addressed through off-model (but exploitable) analyzes, whereas recurring needs (such as implementing new KPIs) should be integrated into the model.

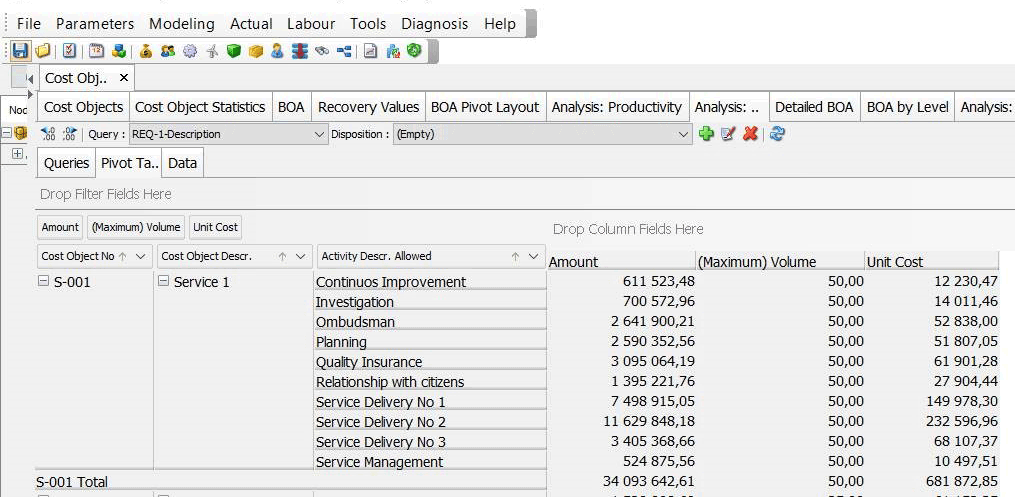

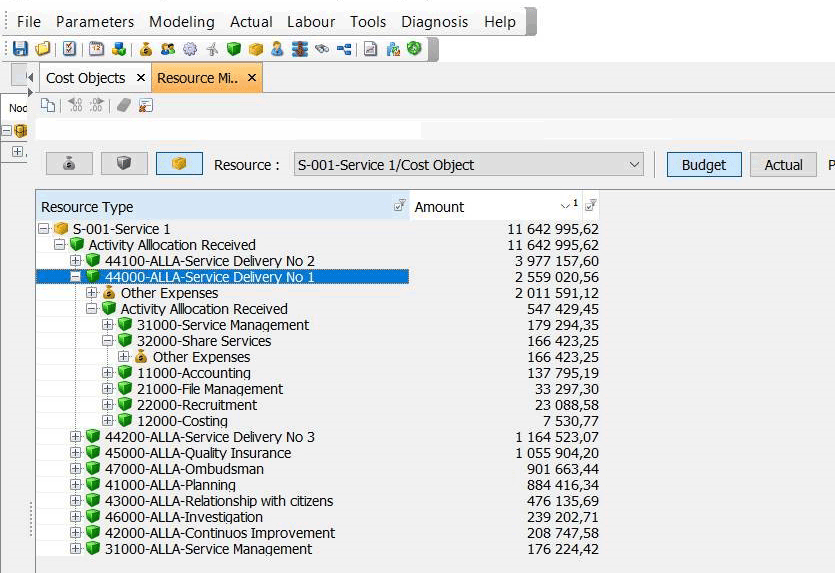

The importance of being transparent

When the cost model is first put in place, people will inevitably have questions, some of which may come out of left field. We must provide answers to these questions if we want to get buy-in for the model, and this means we must be totally transparent about product, service and program costs. We also need to ensure that the people who pilot the model can answer these questions. If we want to show that the model is worthwhile and get approval and buy-in from the organization, it’s crucial to provide access to the results, deliver a breakdown of the results, and demonstrate the model’s total transparency in terms of cost flow.

Transparency and breakdown of results – Sample page

An experienced implementation team

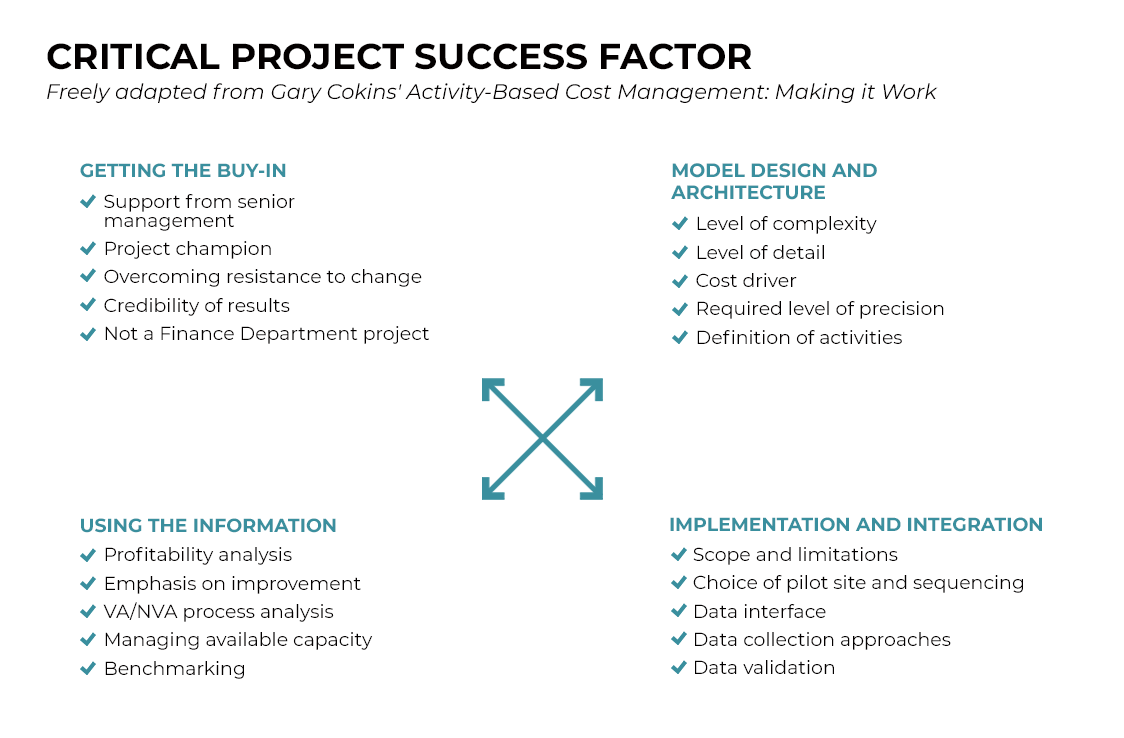

Implementing an effective cost model is a complex process with significant policy, organizational and operational implications, one that involves interviewing and managing the expectations of many different stakeholders as well as researching, compiling and organizing data from a variety of sources. A project of this scope requires access to a qualified, specialized team to ensure that the implementation goes as smoothly as possible and that all stated business objectives are met. As shown by the summary of critical cost model success factors (below), those in charge of implementation must keep many factors in mind throughout the process, and the ability to do so only comes with experience.

Summary of best cost model implementation practices

THE PUBLIC SECTOR

While there are obvious cost-benefit considerations, having a good cost model helps the public sector achieve a balanced budget.

Tracking the sources and uses of funding can be a complex task. If a department or agency receives an amount to manage a particular program, project or law, it is obliged to use the allocated funds only for the intended purpose. However, when personnel are shared, assigned to several tasks and/or involved in several projects, assigning their cost to the right activities – and, by extension, demonstrating accountability – becomes a challenge. Cost models track the funding of all resources, including product, service and program delivery, thereby showing that the organization is indeed using the funds for their intended purpose. Similarly, a documented and transparent cost model enables the organization to show that it doesn’t have the funds to run a certain project or program. If an analysis reveals that the funds for it to fulfill its mandate are lacking, management information will help explain the reasons it’s under-funded.

Departments and agencies need to know the cost of their programs in order to be accountable, but making these calculations can be complex, hard to implement, and dissimilar across organizations. When they must decide whether or not to renew a program, they must take into account a variety of qualitative factors, such as changes to its clientele, shifting political priorities, issues of program relevance, etc. As for the quantitative factors, they must be solid, transparent and justifiable and be based on costing best practices.

A cost model enables departments and agencies to ascertain the full cost of their programs and therefore know what amount, if any, should be re-invoiced. It also enables them find out, at any time, what human, financial, and material resources are available to them in the event a program is not renewed. Ministers can easily see where savings could be made, and how, where and how many employees could be reassigned.

Public bodies must invoice the full cost of their services to ensure that they recover all the amounts spent providing the service, and not make a profit. Departments and agencies that provide fee-based services are subject to this obligation, and so are periodically audited by the Auditor General (AG) of Quebec. The AG requires that the method and calculations be shown, to ensure that the organization effectively manages its resource allocations and that there are no errors in the model, such as funds allocated to the wrong program, or management fees inappropriately levied on certain services. Having a transparent tool and model means Finance can show how the funds are used and for which activity and, ultimately, how they affect the costs of various programs.

Finance can do so by generating a specially prepared screen or report that shows auditors how the organization handles cost allocation and pricing. Using the well-documented model, Finance can easily correct any errors found by the audit, and also see how those corrections will affect the results.

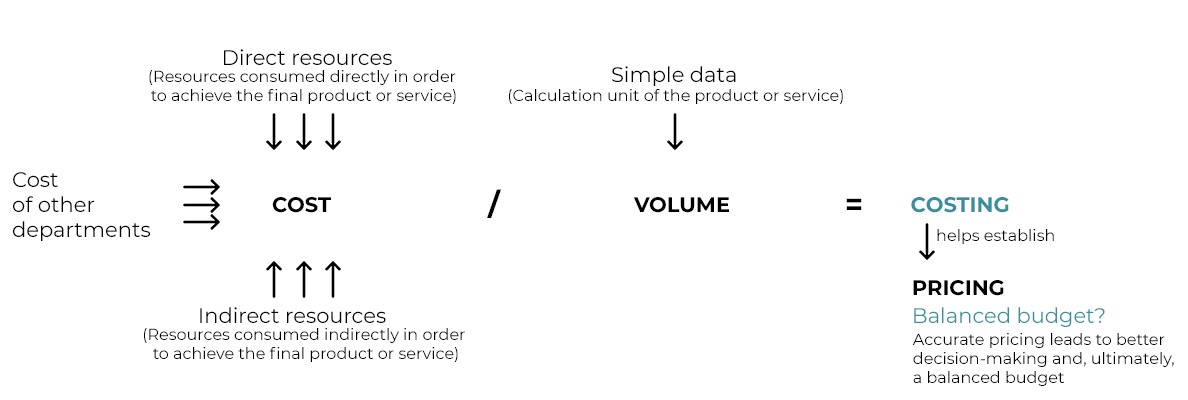

Effective costing also enables you to carry out interdepartmental or external benchmarking or simply have a benchmark with which to compare the previous months or years. Thoroughly understanding the two cost axes (dollars and volume) enables managers to improve their services more effectively, either by optimizing their own costs or by reviewing more critically the costs received. Good complementary indicators also enable them to either reduce or increase the volume, depending on need.

THE PRIVATE SECTOR

The private sector’s main priority is maximizing profits. Regardless of the type of business, its complexity and occupation level (or capacity), implementing a cost model gives it the tools to make solid, measurable and verifiable decisions that positively impact profit and performance.

A good cost model will first and foremost produce the full cost of all the company’s products and services, as well as a breakdown of those costs. Comparing this amount to the company’s current pricing enables it to target the loss-making products/services and devise an action plan to address the problem. Moving forward, the company has many options: eliminate the product or service, replace it, optimize it, consolidate it, or redirect sales efforts to higher-margin products. A good cost tool enables managers to create different scenarios and come up with a financially sound and approved option, one that is able to support the qualitative considerations that must be taken into account in this type of decision.

You would be surprised to learn how much time companies spend managing products and/or services that are not central to their strategic operations. The objective is to help companies maximize their profits without investing a penny, simply by focussing on their core, profitable products/services.

Once the company knows the full cost of all its products and services, it must pass this knowledge on to the sales team so they can drive sales of high-profit-margin products. Integrating sales and operations can mean adjusting the variable compensation of people in business development by paying commissions on the sales margin rather than on the sales themselves. If the company decides to go this route, the finance team will have to explain the margins of the various products/services to the sales team; a costing tool will be essential in answering their questions and focussing resources on established targets.

Linking sales and operations enables manufacturing companies to predict their production volume per period, thereby anticipating potential capacity problems. Maximizing profitability in a full-capacity production chain means identifying the bottleneck, understanding why its there, and ascertaining the profit margin per constraint factor unit. A cost model is the perfect tool for performing all the steps in this complex process, which in turn can be a springboard for asking what level of production generates maximum profits and bringing sales in line with the resulting response. For example, if a production line bottleneck is caused by a specialized machine that is expensive to replace and whose use is limited, managers will need to determine the most profitable products produced by this machine, per hours of use, and then prioritize the sale of these products over those with a lower profit margin per machine/hour.

For service companies, the problem of bottlenecks, or their ability to offer a service, also significantly affects their profitability, and sales must take these constraint factors into account.

Costing isn’t just a way to find out the price at which a product or service should be sold. It’s also a way to see costs more clearly, both at the product level and company-wide. Clearly defined and well understood costing enables companies to identify the opportunities for financial optimization.

Whether you’re in the public or private sector, you can choose from a number of costing methods. The most popular are: standard, full, marginal and target costing, activity-based costing and costing based on operational constraints. But remember: whichever method you choose, it should fit with your company’s type of business and management style. Finally, good costing is not something that is undertaken once every few years. On the contrary, it should be an integral part of your day-to-day operations and year-end financial analyses.